There are three major drivers for business agility within the banking sector: fierce competition within the sector, constantly changing regulatory and compliance requirements, and finally, customer expectation and buying behavior. While compliance has taken center stage since the Great Recession of 2008, the focus has been moving increasingly to digital transformation, particularly improving Customer Experience (CX). This has led to some banks becoming technology powerhouses first, and banking institutions second, and Capital One is probably the preeminent example of this.

Bain & Company published an article back in 2014 (Rebooting IT: Why Financial Institutions Need a New Technology Model) which outlined how technology has taken center stage. In particular, the authors articulated how a significant gap existed between “executives demand [for] greater speed and agility, but their IT departments are unable to deliver, resulting in frustrations and mutual distrust.”

Banking chiefs are demanding their operations become faster, responsive, and leaner – i.e., do more with less – however, IT departments have become paralyzed by rapid digital growth, overburdened with changes caused by regulatory regimes that change with the wind, and transformed into an orphanage of legacy systems and applications that are critical to operations. And all of this is set against a revolution in customer expectation fueling demand for more products and services.

This is not an IT problem – it is a strategic business challenge for the banking sector. The main issue is how do you bridge that gap and deliver speed, agility, with compliance control, without breaking your IT department or expending vast sums of money?

Business Process Management Functionality in the Hands of Citizen Developers

If we agree that the bottleneck in transformation is caused by IT departments becoming overwhelmed, then the main question is whether or not there is an alternative to the IT department (or third parties) being responsible for the delivery of change to systems and processes required.

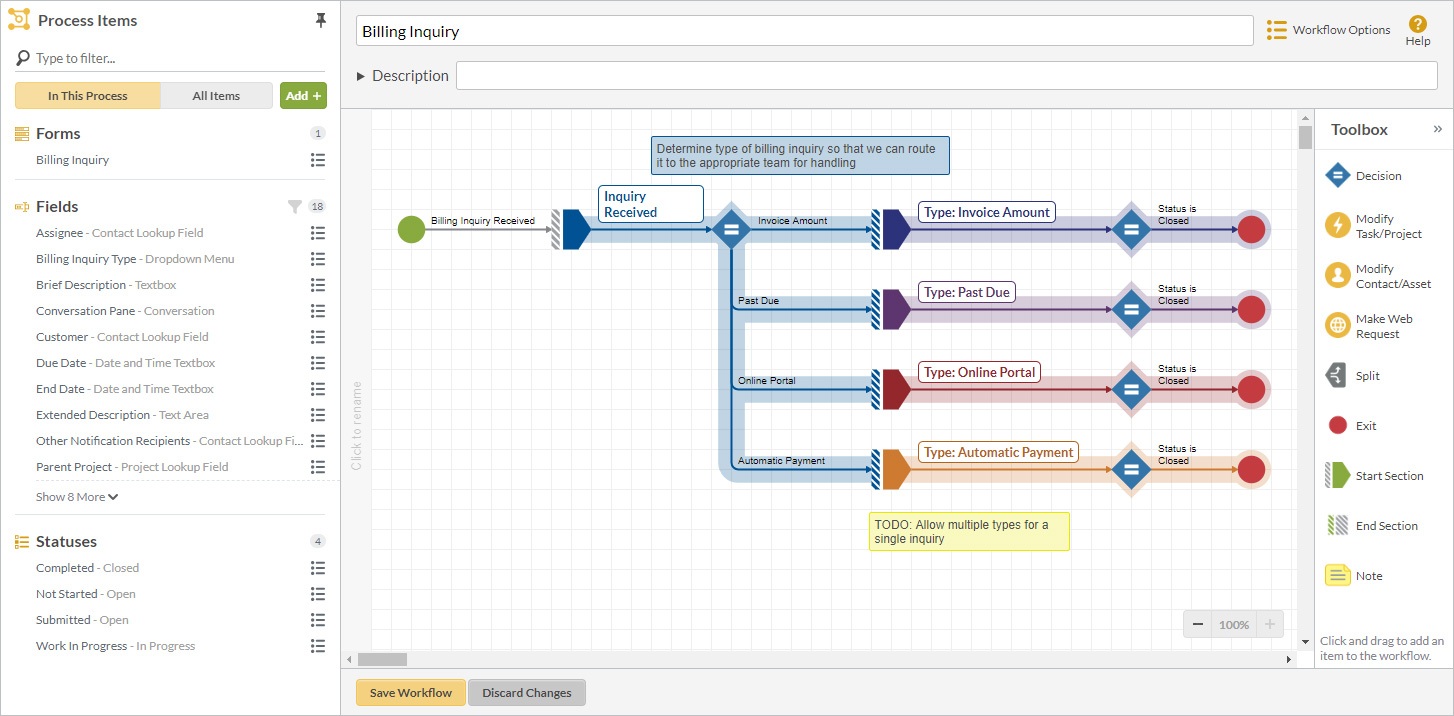

Lean BPM has been developed to tackle the issue of bloated BPM deployments, which are themselves fraught with waste and risk. The major differentiator of Lean BPM from any other BPM solution (traditional or low code) is that the business person wields the functionality without the need for coding or dev skills – the Citizen Developer. It is the Citizen Developer who makes changes to the business processes involved directly, with no need for the IT department to support or deliver requirements.

This means that when a process change is identified, whether as a result of a new product launch, a regulatory change requiring an additional box be checked off, or as a result of internal process improvement activities, then changes are made by the team involved themselves.

For instance, a business analyst identifies a potential improvement in an audit process which requires adjusting the step order of several constituent tasks. Ordinarily, IT or a third-party coder would take the required changes and make the adjustments to whatever work platform was involved, and then, typically months later, hand over the deliverables. Using Lean BPM, the team within which the business analyst sits will make the changes themselves immediately (subject to whatever controls need to be in place to manage such process change).

What this means is that months of delay are avoided, there is no additional burden placed on IT, nor cost associated with third-party vendors, and change is immediate (and cheap). If the change is beneficial, it can be rolled out to a wider set of groups and teams, or if the real-world data shows the change is not beneficial, simply revert back to the prior state and reiterate on your process improvement efforts.

A further example is where a regulator requires an additional piece of identification is provided as part of “Know Your Customer” (KYC) rules. A scenario may be that your regulator now requires your Customer Identification Program (CIP) to ensure you obtain two forms of government issued identification showing their home address (as opposed to one). Again, a Lean BPM platform allows the CIP team to effect the changes themselves as soon as they need to be implemented, and the changes will be pushed into a live operational state which also ‘bakes in’ the new compliance requirement by ensuring customer-facing staff cannot close a task down until they have checked off 2 forms of government issued ID have been obtained from the customer (and if required, uploaded scans of the aforementioned documents which are now attached to that customer record, or associated workflow).

What is Lean BPM Exactly?

Lean BPM has been developed to tackle the issues associated with traditional and low-code BPM deployments. In particular, there is substantial waste associated with deployment, with extended periods of time taken up in mapping existing processes, creating replacement processes (which may or may not improve performance), and implementing the BPM solution itself.

In practical terms, this can take many months, if not years, account for a huge chunk of budget and there can also be a greater risk of failure.

There is also the waste associated with the operation of traditional or low-code BPM solution, and this is because they still need specialists to operate them, especially where change is needed. Low-code BPM has tried to deal with the issue of traditional BPM deployments not being particularly agile when it comes to change, but they still need specialist developers to run them effectively, increasing costs and still not being as agile and fast as your customers and business needs to be.

Lean BPM requires no specialist coding or development skills. If you can draw a process on a white board, you can use Visual Workflow. If you can use a Visual Workflow, you can replicate any business process operating within your bank or institution directly within the platform. Note: this can be done immediately, not by the IT department but by the team involved itself. The issue is how you control the process of changing your processes, not how long will it take for the changes to be made themselves.

Summary

Banking chiefs want more done with less, with a need for speed and agility created by customer expectations, aggressive and complex regulatory regimes, and very high competitive pressures within the sector.

Banking IT departments have struggled to deliver speed and agility, instead becoming slower and more expensive.

This is not IT’s fault, nor is this an IT problem – it is a strategic challenge facing banks.

Lean BPM cuts out the bottleneck between identifying change required and delivering requirements. The Citizen Developer now makes the required process changes, without the need for IT involvement or for expensive third-party vendors.

Lean BPM makes process improvement faster and cheaper, delivering true banking process agility and speed without an expensive BPM price tag.